Despite making more than $40 million, former NFL RB Clinton Portis is broke

- Thread starter Prime Time

- Start date

-

To unlock all of features of Rams On Demand please take a brief moment to register. Registering is not only quick and easy, it also allows you access to additional features such as live chat, private messaging, and a host of other apps exclusive to Rams On Demand.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

There's still a WNBA? Who knew?Wait.

Sherrell Swoopes made 50 mill playing in the WNBA?

That had to be from endorsements.

- Thread Starter Thread Starter

- #23

http://www.forbes.com/sites/leighst...asons-why-80-of-retired-nfl-players-go-broke/

FEB 9, 2015

5 Reasons Why 80% Of Retired NFL Players Go Broke

By Leigh Steinberg

Sports Illustrated recently estimated that 80% of retired NFL players go broke in their first three years out of the League. How is this possible in a sport rolling in revenue with an average salary of almost $2 million a year? With few exceptions, the star players I have represented since salaries exploded are set financially for life. These are the players at the tip of the compensation pyramid, but what about the rest? The median income in the NFL is roughly $750,000 and the average career span is less than four years. Most college graduates don’t attain these levels of revenue in their first years out of college–why are the athletes struggling?

1)Lack of competent financial planning advice–Athletes are no different than any other college grads in that they were not trained as undergrads in budgeting, the tax system, and long term financial planning. This is an area of specialized expertise and an athlete receiving large compensation needs a safety net of advisors. Upon signing a potential draftee we encouraged them to pick a qualified financial advisor with a proven track record. These advisors help the athlete put together a budget, follow mutually agreed upon strategies, and protect themselves legally. A community oriented athlete will find beneficial relationships with businessmen off the field who are also willing to help.

When parents, university panels, and alums screen prospective agents and financial planners, it enables the athlete to make a better choice. But many NFLers are approached on campus by financial planners and agents who offer financial inducements to sign with them. Some financial planners ask players to sign power of attorney enabling the advisor to make investments or withdraw money without prior authorization–this is fraught with peril.

The NFLPA has tried to protect players financially. They have a program that scrutinizes financial planners and only allows referrals to the planners who they approve. The NFLPA offers education in the financial areas in a variety of ways. The NFL holds a mandatory seminar for draft picks that also tries to warn and protect them. Some athletes do not avail themselves of any of these protections.

2)Supporting a village–Some athletes feel obliged to provide financial support to family, extended family and friends. They are sharing their largess with a large number of others.

3)Divorce–Often cited as the number one challenge, divorce drains funds in legal fees and dissipates assets. The athlete ends up with half of what they earned and may have large and burdensome alimony and child support payments.

4)Lack of awareness of how rapidly a career can end–The athlete forgets that the current rate of compensation is not going to last and can be terminated by injury or skill at any point. Spending habits assume the revenue will be coming forever.

5)Lack of preparation for second career–NFL players have long off seasons they can use to lay the foundation for their life after football. Some athletes do not give it a thought and end up missing the structure and direction that football has given them. The early retirement years can be non-productive.

There are gifted advisors that an athlete can utilize. The League, NFLPA and agents try and push athletes to use help which also embodies a teaching aspect that can empower awareness. It is up to the athlete to follow the guidance.

http://www.nationalfootballpost.com/ten-reasons-why-nfl-players-go-broke/

Five Reasons Why NFL Players Go Broke

By Jack Bechta

) Gross vs. net: It never fails; when my clients get their first NFL check they call me and say something is wrong. They are floored by how much is taken out for taxes and other deductions. Unfortunately, the shock doesn’t resonate long enough. I would say 90% of players have some type of direct deposit or their check gets mailed to their investment advisor and the players never see the net amount. Thus, they think they always are making more money (in gross numbers) than they actually are.

2) It comes too easy and too fast: First it’s a college scholarship, cash from uncles during college, advances and stipends from agents and financial advisors. A large signing bonus before the first snap in camp and making a team. When money comes fast and easy for a young man the assumption is life will always be that way. Players can easily develop a false sense of value of themselves.

Many think that starting a profitable business or landing a high paying six-figure cushy job will be easy after football. Why not, everything else came easy right? Wrong! Players have a rude awaking when they can't even land a coaching job after their career ends and don’t properly prepare for starting a second career.

3) The cost of vanity: I tell my friends that if I opened a specialized rim shop serving pro athletes, instead of being an agent, I would be a rich man. The same goes for custom jewelry. Unfortunately, I noticed that many athletes associate wealth with material possession. So they feel like the more they have, the richer they are. I would say 90% of all athletes are getting ripped off on auto and jewelry purchases.

I had one client have a watch appraised that he thought was worth over the $20,000 that he paid for it. The appraiser valued it at $1,500. The diamonds he thought he had on the watch weren’t real. I did it to teach him a lesson. The obsession to have the latest and greatest toys, the biggest house, the newest car(s) and most expensive clothes is probably the number one wealth killer for professional athletes. As I always say, “rich people have things, wealthy people have investments”.

4) Weak financial counsel: What I mean by this is that most financial advisors, accountants and confidants I met and observed over the years don’t have the fortitude to stand up to their clients in fear of losing them. If they ride their clients too hard about spending the athlete may just fire him or her. So they tend not to make the hard calls and put their foot down on spending patterns.

For many consultants, it’s a race to invest the players’ assets before they spend it. Consultants who take their time to educate, communicate and have a way of helping players control spending get an A+ in my book but they are few and far between.

5) Bad investments: There are some intelligent football players who made some really bad investments. The problem is usually compounded when they make a big bet with the majority of their savings on real estate or a business. In addition, many of them sign personal guarantees on loan deals in addition to the investment.

FEB 9, 2015

5 Reasons Why 80% Of Retired NFL Players Go Broke

By Leigh Steinberg

Sports Illustrated recently estimated that 80% of retired NFL players go broke in their first three years out of the League. How is this possible in a sport rolling in revenue with an average salary of almost $2 million a year? With few exceptions, the star players I have represented since salaries exploded are set financially for life. These are the players at the tip of the compensation pyramid, but what about the rest? The median income in the NFL is roughly $750,000 and the average career span is less than four years. Most college graduates don’t attain these levels of revenue in their first years out of college–why are the athletes struggling?

1)Lack of competent financial planning advice–Athletes are no different than any other college grads in that they were not trained as undergrads in budgeting, the tax system, and long term financial planning. This is an area of specialized expertise and an athlete receiving large compensation needs a safety net of advisors. Upon signing a potential draftee we encouraged them to pick a qualified financial advisor with a proven track record. These advisors help the athlete put together a budget, follow mutually agreed upon strategies, and protect themselves legally. A community oriented athlete will find beneficial relationships with businessmen off the field who are also willing to help.

When parents, university panels, and alums screen prospective agents and financial planners, it enables the athlete to make a better choice. But many NFLers are approached on campus by financial planners and agents who offer financial inducements to sign with them. Some financial planners ask players to sign power of attorney enabling the advisor to make investments or withdraw money without prior authorization–this is fraught with peril.

The NFLPA has tried to protect players financially. They have a program that scrutinizes financial planners and only allows referrals to the planners who they approve. The NFLPA offers education in the financial areas in a variety of ways. The NFL holds a mandatory seminar for draft picks that also tries to warn and protect them. Some athletes do not avail themselves of any of these protections.

2)Supporting a village–Some athletes feel obliged to provide financial support to family, extended family and friends. They are sharing their largess with a large number of others.

3)Divorce–Often cited as the number one challenge, divorce drains funds in legal fees and dissipates assets. The athlete ends up with half of what they earned and may have large and burdensome alimony and child support payments.

4)Lack of awareness of how rapidly a career can end–The athlete forgets that the current rate of compensation is not going to last and can be terminated by injury or skill at any point. Spending habits assume the revenue will be coming forever.

5)Lack of preparation for second career–NFL players have long off seasons they can use to lay the foundation for their life after football. Some athletes do not give it a thought and end up missing the structure and direction that football has given them. The early retirement years can be non-productive.

There are gifted advisors that an athlete can utilize. The League, NFLPA and agents try and push athletes to use help which also embodies a teaching aspect that can empower awareness. It is up to the athlete to follow the guidance.

http://www.nationalfootballpost.com/ten-reasons-why-nfl-players-go-broke/

Five Reasons Why NFL Players Go Broke

By Jack Bechta

) Gross vs. net: It never fails; when my clients get their first NFL check they call me and say something is wrong. They are floored by how much is taken out for taxes and other deductions. Unfortunately, the shock doesn’t resonate long enough. I would say 90% of players have some type of direct deposit or their check gets mailed to their investment advisor and the players never see the net amount. Thus, they think they always are making more money (in gross numbers) than they actually are.

2) It comes too easy and too fast: First it’s a college scholarship, cash from uncles during college, advances and stipends from agents and financial advisors. A large signing bonus before the first snap in camp and making a team. When money comes fast and easy for a young man the assumption is life will always be that way. Players can easily develop a false sense of value of themselves.

Many think that starting a profitable business or landing a high paying six-figure cushy job will be easy after football. Why not, everything else came easy right? Wrong! Players have a rude awaking when they can't even land a coaching job after their career ends and don’t properly prepare for starting a second career.

3) The cost of vanity: I tell my friends that if I opened a specialized rim shop serving pro athletes, instead of being an agent, I would be a rich man. The same goes for custom jewelry. Unfortunately, I noticed that many athletes associate wealth with material possession. So they feel like the more they have, the richer they are. I would say 90% of all athletes are getting ripped off on auto and jewelry purchases.

I had one client have a watch appraised that he thought was worth over the $20,000 that he paid for it. The appraiser valued it at $1,500. The diamonds he thought he had on the watch weren’t real. I did it to teach him a lesson. The obsession to have the latest and greatest toys, the biggest house, the newest car(s) and most expensive clothes is probably the number one wealth killer for professional athletes. As I always say, “rich people have things, wealthy people have investments”.

4) Weak financial counsel: What I mean by this is that most financial advisors, accountants and confidants I met and observed over the years don’t have the fortitude to stand up to their clients in fear of losing them. If they ride their clients too hard about spending the athlete may just fire him or her. So they tend not to make the hard calls and put their foot down on spending patterns.

For many consultants, it’s a race to invest the players’ assets before they spend it. Consultants who take their time to educate, communicate and have a way of helping players control spending get an A+ in my book but they are few and far between.

5) Bad investments: There are some intelligent football players who made some really bad investments. The problem is usually compounded when they make a big bet with the majority of their savings on real estate or a business. In addition, many of them sign personal guarantees on loan deals in addition to the investment.

Dieter the Brock

Fourth responder

No, it's not.

It's not hard to understand how people that grew up with nothing and suddenly hit the jackpot coming out of college could squander it all. They didn't grow up with people that knew how to manage money and could teach them how to protect and grow their wealth. When they get that wealth, they try to have the lifestyle they always wanted with it rather than saving and growing it. Even the guys that try to invest typically don't have a background where they understand how to invest and make bad decisions with investments or are taken advantage of by people around them. Not to mention all of their boys and family have their hands out as soon as they get that money.

It's a minefield for these guys. They absolutely have my sympathy.

Even some of the guys that think they're making good decisions by investing their money lose it. Whether it's because they were duped by more sophisticated businessmen or wrecked by bad luck with the market/business or made a poor decision on what to invest in.

Lottery winners have the same issue. It's because when you get an influx of cash without having money like that before, you don't know how to manage it like a person that worked their way up to it.

I know of a former NFL player that lost much of his fortune through bad business investments. Very nice guy. Very intelligent. Family man. Still lost a ton of money when his business ventures went bad. It happens.

Well I'm one of the ones who grew up with nothing and hit the jackpot when I was young -- and I'm in a solid financial situation and am currently working on giving that gift to my children's children .

But I can say Growing up with nothing makes you appreciate what you have 1000x more. Honestly I give thanks all day long for what I have and I go to bed every night with the memories of having nothing. It keeps me honest and God-fearing.

But I guarantee you that the reason you're reading about these people who lost their money - they are extremely rare, and I'm taking across the spectrum of the sporting world,

The vast vast majority of players coming from low income to hitting the jackpot do smart and prudent things with their money

Portis is the exception - not the rule

Dieter the Brock

Fourth responder

80% of retired NFL players go broke?

Wow don't know where they got that number, but that is shocking if true

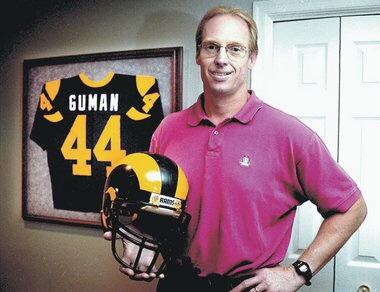

My suggestion for all these players is to hire MIKE GUMAN financial adviser for Oppenheimer funds

https://www.linkedin.com/in/mike-guman-799bab34

Wow don't know where they got that number, but that is shocking if true

My suggestion for all these players is to hire MIKE GUMAN financial adviser for Oppenheimer funds

https://www.linkedin.com/in/mike-guman-799bab34

That's not what happened with Portis though. At least not according to the article.I know of a former NFL player that lost much of his fortune through bad business investments. Very nice guy. Very intelligent. Family man. Still lost a ton of money when his business ventures went bad. It happens.

... extravagant living that couldn't be curtailed once the big game checks stopped.

Seems like he was living beyond his means even when he had the means. That's just dumb and it's a personal decision to waste money. Not to mention reneging on his responsibilities for child support with four different women. This isn't a guy who fell into some bad luck via bad financial investment opportunities. It's just a guy who thought the well would never dry up and didn't plan for life past football.