Let's agree that diamonds are bullshit and reject their role in the marriage process. Let's admit that as a society we got tricked for about century into coveting sparkling pieces of carbon, but it's time to end the nonsense.

www.huffpost.com

Diamonds Are Bullshit

American males enter adulthood through a peculiar rite of passage — they spend most of their savings on a shiny piece of rock. They could invest the money in assets that will compound over time and someday provide a nest egg. Instead, they trade that money for a diamond ring, which isn’t much of an asset at all. As soon as you leave the jeweler with a diamond, it loses over 50 percent of its value.

Americans exchange diamond rings as part of the engagement process, because in 1938 De Beers decided that they would like us to. Prior to a stunningly successful marketing campaign 1938, Americans occasionally exchanged engagement rings, but wasn’t a pervasive occurrence. Not only is the demand for diamonds a marketing invention, but diamonds aren’t actually that rare. Only by carefully restricting the supply has De Beers kept the price of a diamond high.

Countless American dudes will attest that the societal obligation to furnish a diamond engagement ring is both stressful and expensive. But here’s the thing — this obligation only exists because the company that stands to profit from it willed it into existence.

So here is a modest proposal: Let’s agree that diamonds are bullshit and reject their role in the marriage process. Let’s admit that as a society we got tricked for about a century into coveting sparkling pieces of carbon, but it’s time to end the nonsense.

The Concept of Intrinsic Value

In finance, there is concept called

intrinsic value. An asset’s value is essentially driven by the (discounted) value of the future cash that asset will generate. For example, when Hertz buys a car, its value is the profit they get from renting it out and selling the car at the end of its life (the “terminal value”). For Hertz, a car is an investment. When you buy a car, unless you make money from it somehow, its value corresponds to its

resale value. Since a car is a depreciating asset, the amount of value that the car loses over its lifetime is a very real expense you pay.

A diamond is a depreciating asset masquerading as an investment. There is a common misconception that jewelry and precious metals are assets that can store value, appreciate and hedge against inflation. That’s not wholly untrue.

Gold and silver are commodities that can be purchased on financial markets. They can appreciate and hold value in times of inflation. You can even hoard gold under your bed and buy gold coins and bullion (albeit at a

~10 percent premium to market rates). If you want to hoard gold jewelry however, there is typically a retail markup so that’s probably not a wise investment.

But with that caveat in mind, the market for gold is fairly liquid and gold is fungible — you can trade one large piece of gold for 10 smalls ones like you can a 10 dollar bill for 10 one dollar bills. These characteristics make it a feasible potential investment.

Diamonds, however, are

not an investment. The market for them is neither liquid nor are they fungible.

The first test of a liquid market is whether you can resell a diamond. In a famous piece published by

The Atlantic in 1982, Edward Epstein explains why you can’t sell used diamonds for anything but a pittance:

When you buy a diamond, you buy it at retail, which is a 100 percent to 200 percent markup. If you want to resell it, you have to pay less than wholesale to incent a diamond buyer to risk their own capital on the purchase. Given the large markup, this will mean a substantial loss on your part. The same article puts some numbers around the

dilemma:

Some diamonds are perhaps investment grade, but you probably don’t own one, even if you spent a lot.

As with

televisions and

mattresses, the diamond classification scheme is extremely complicated. Diamonds are not fungible and can’t be easily exchanged with each other. Diamond professionals use the four C’s when classifying and pricing diamonds: carats, color, cut, and clarity. Due to the complexity of these four dimensions, it’s hard to make apples to apples comparisons between diamonds.

But even when looking at the value of one stone, professionals seem like they’re just making up diamond

prices:

So let’s be very clear, a diamond is not an investment. You might want one because it looks pretty or its status symbol to have a “massive rock,” but not because it will store value or appreciate in value.

But among all the pretty, shiny things out there - gold and silver, rubies and emeralds - why do Americans covet diamond engagement rings in the first place?

A Diamond is Forever a Measure of your Manhood

We like diamonds because

Gerold M. Lauck told us to. Until the mid 20th century, diamond engagement rings were a

small and dying industry in America. Nor had the concept really taken hold in Europe. Moreover, with Europe on the verge of war, it didn’t seem like a promising place to invest.

Not surprisingly, the American market for diamond engagement rings began to shrink during the Great Depression. Sales volume declined and the buyers that remained purchased increasingly smaller stones. But the US market for engagement rings was still

75 percent of De Beers’ sales. If De Beers was going to grow, it had to reverse the trend.

And so, in 1938, De Beers turned to Madison Avenue for help. They hired Gerold Lauck and the N. W. Ayer advertising agency, who commissioned a study with some astute observations. Men were the key to the

market:

However, there was a dilemma. Many smart and prosperous women didn’t want diamond engagement rings. They wanted to be different.

Lauck needed to sell a product that people either did not want or could not afford. His solution would haunt men for generations. He advised that De Beers market diamonds as a

status symbol:

The next time you look at a diamond, consider this. Nearly every American marriage begins with a diamond because a bunch of rich white men in the 1940s convinced everyone that its size determines your self worth. They created this convention — that unless a man purchases (an intrinsically useless) diamond, his life is a failure — while sitting in a room, racking their brains on how to sell diamonds that no one wanted.

With this insight, they began marketing diamonds as a symbol of status and love:

Even the royal family was in on the hoax! The campaign paid immediate dividends. Within three years, despite the Great Depression, diamond sales in the U.S. increased 55 percent! Twenty years later, an entire generation believed that an expensive diamond ring was a necessary step in the marriage process.

The De Beers marketing machine continued to churn out the hits. They circulated

marketing materials suggesting, apropos of nothing, that a man should spend one month’s salary on a diamond ring. It worked so well that De Beers arbitrarily decided to increase the suggestion to two months salary. That’s why you think that you need to spend two month’s salary on a ring — because the suppliers of the product said so.

Today, over

80 percent of women in the U.S. receive diamond rings when they get engaged. The domination is complete.

A History of Market Manipulation

What, you might ask, could top institutionalizing demand for a useless product out of thin air? Monopolizing the supply of diamonds for over a century to make that useless product extremely expensive. You see, diamonds aren’t really even that rare.

Before 1870, diamonds were very rare. They typically ended up in a Maharaja’s crown or a royal necklace. In 1870, enormous deposits of diamonds were discovered in Kimberley, South Africa. As diamonds flooded the market, the financiers of the mines realized they were making their own investments worthless. As they mined more and more diamonds, they became less scarce and their price dropped.

The diamond market may have bottomed out were it not for an enterprising individual by the name of

Cecil Rhodes. He began buying up mines in order to control the output and keep the price of diamonds high.

By 1888, Rhodes controlled the entire South African diamond supply, and in turn, essentially the entire world supply. One of the companies he acquired was eponymously named after its founders, the De Beers brothers.

Building a diamond monopoly

isn’t easy work. It requires a balance of ruthlessly punishing and cooperating with competitors, as well as a very long term view. For example, in 1902, prospectors discovered a massive mine in South Africa that contained as many diamonds as all of De Beers’ mines combined. The owners initially refused to join the De Beers cartel, joining three years later after new owner Ernest Oppenheimer recognized that a competitive market for diamonds would be disastrous for the

industry:

Here’s how De Beers has controlled the diamond supply chain for

most of the last century. De Beers owns most of the diamond mines. For mines that they don’t own, they have historically bought out all the diamonds, intimidating or co-opting any that think of resisting their monopoly. They then transfer all the diamonds over to the Central Selling Organization (CSO), which they own.

The CSO sorts through the diamonds, puts them in boxes and presents them to the 250 partners that they sell to. The price of the diamonds and quantity of diamonds are non-negotiable - it’s take it or leave it. Refuse your boxes and you’re out of the diamond industry.

For most of the 20th century, this system has controlled 90% of the diamond trade and been solely responsible for the inflated price of diamonds. However, as Oppenheimer took over leadership at De Beers, he keenly assessed the primary operational risk that the company

faced:

Because diamonds are “valuable”, there will always be the risk of entrepreneurs finding new sources of diamonds. Although controlling the discoverers of new mines often actually meant working with communists.

In 1957, the Soviet Union discovered a massive deposit of diamonds in Siberia. Though the diamonds were a bit on the smallish side, De Beers still had to swoop in and buy all of them from the Soviets, lest they risk the supply being unleashed on the world market.

Later,

in Australia, a large supply of colored diamonds was discovered. When the mine refused to join the syndicate, De Beers retaliated by unloading massive amounts of colored diamonds that were similar to the Australian ones to drive down their price. Similarly, in the 1970s, some Israeli members of the CSO started stockpiling the diamonds they were allocated rather than reselling them. This made it difficult for De Beers to control the market price and would eventually cause a deflation in diamond prices when the hoarders released their stockpile. Eventually, these offending members were banned from the CSO, essentially shutting them out from the diamond business.

In 2000, De Beers announced that they were relinquishing their monopoly on the diamond business. They even settled a US Antitrust lawsuit related to price fixing industrial diamonds to the tune of $10 million (How generous! What is that, the price of one investment banker’s engagement ring?).

Today, De Beers’ hold on the industry supply chain is

less strong. And yet, prices continue to rise as new deposits haven’t been found recently and demand for diamonds is increasing in

India and China. For now, it’s less necessary that the company monopolize the supply chain because its lie that a diamond is a proxy for a man’s worth in life has infected the rest of the world.

Conclusion

We covet diamonds in America for a simple reason: the company that stands to profit from diamond sales decided that we should. De Beers’ marketing campaign single handedly made diamond rings the measure of one’s success in America. Despite the diamond’s complete lack of inherent value, the company manufactured an image of diamonds as a status symbol. And to keep the price of diamonds high, despite the abundance of new diamond finds, De Beers executed the most effective monopoly of the 20th century. Ok, we get it De Beers, you guys are really good at business!

The purpose of this post was to point out that diamond engagement rings are a lie - they’re an invention of Madison Avenue and De Beers. This post has completely glossed over the sheer amount of human suffering that we’ve caused by believing this lie:

conflict diamonds funding wars, supporting apartheid for decades with our money, and pillaging the earth to find shiny carbon. And while we’re on the subject, why is it that

women need to be asked and presented with a ring in order to get married? Why can’t they ask and do the presenting?

Diamonds are not actually scarce, make a terrible investment, and are purely valuable as a status symbol.

Diamonds, to put it delicately, are bullshit.

www.foxnews.com

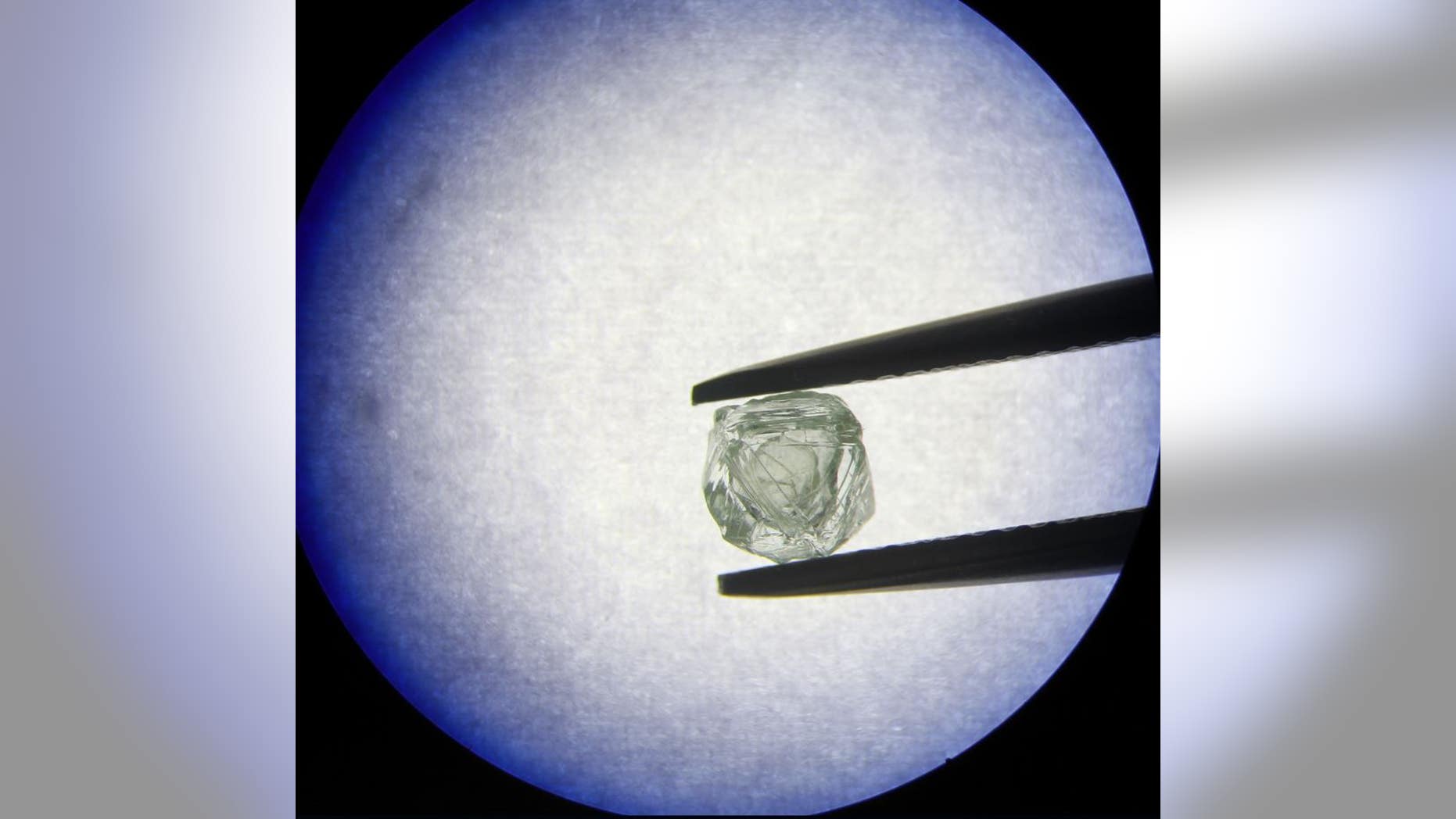

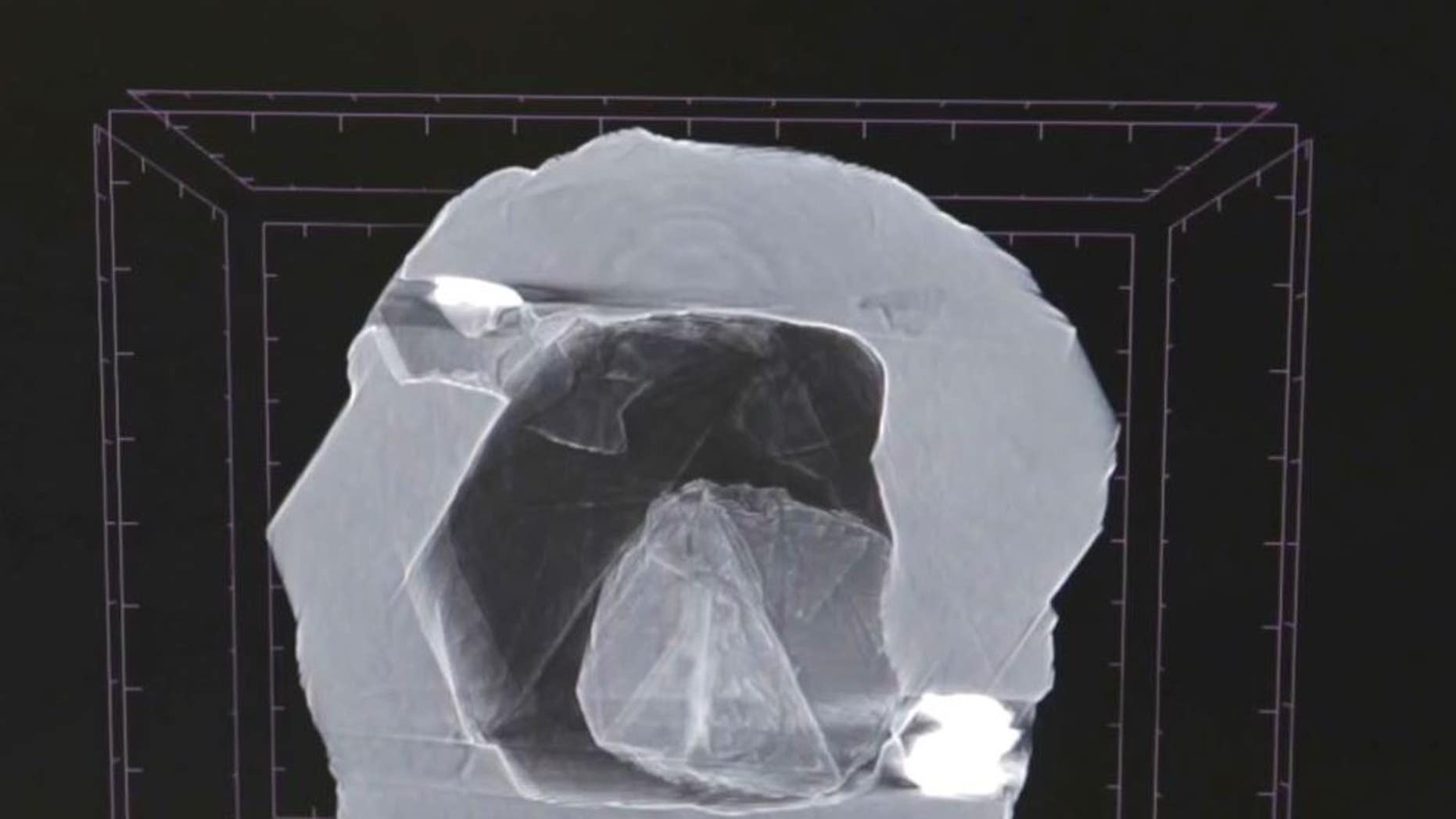

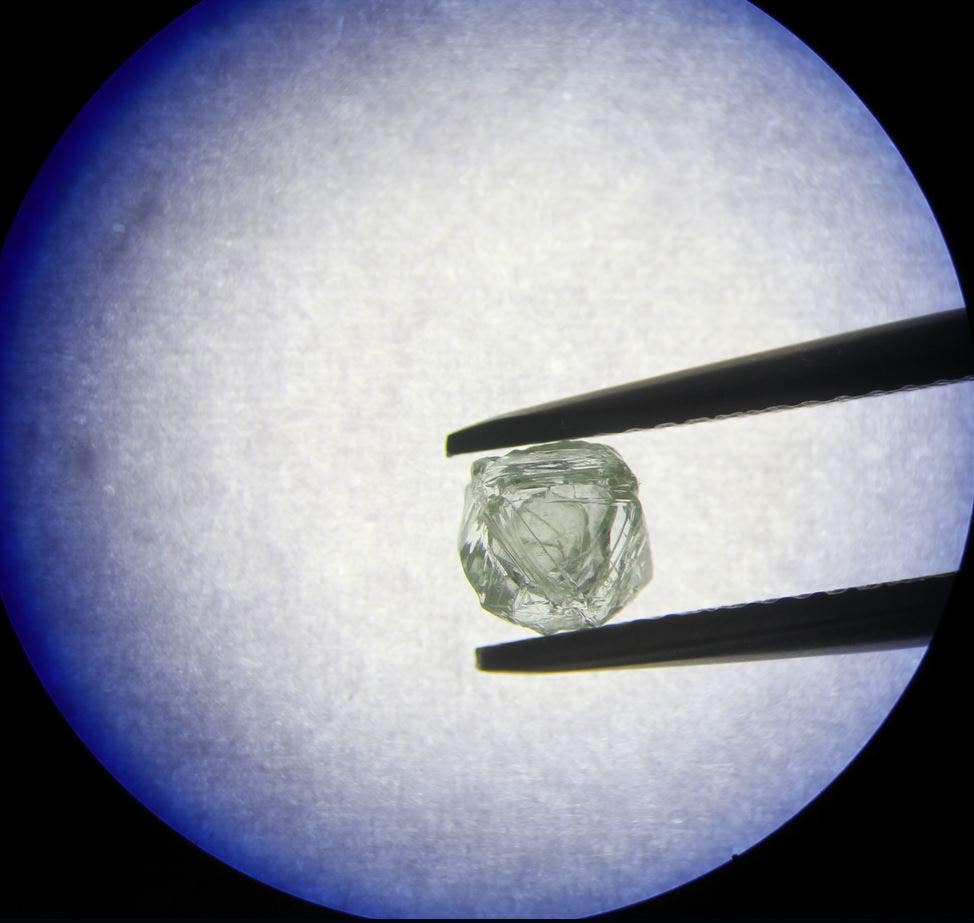

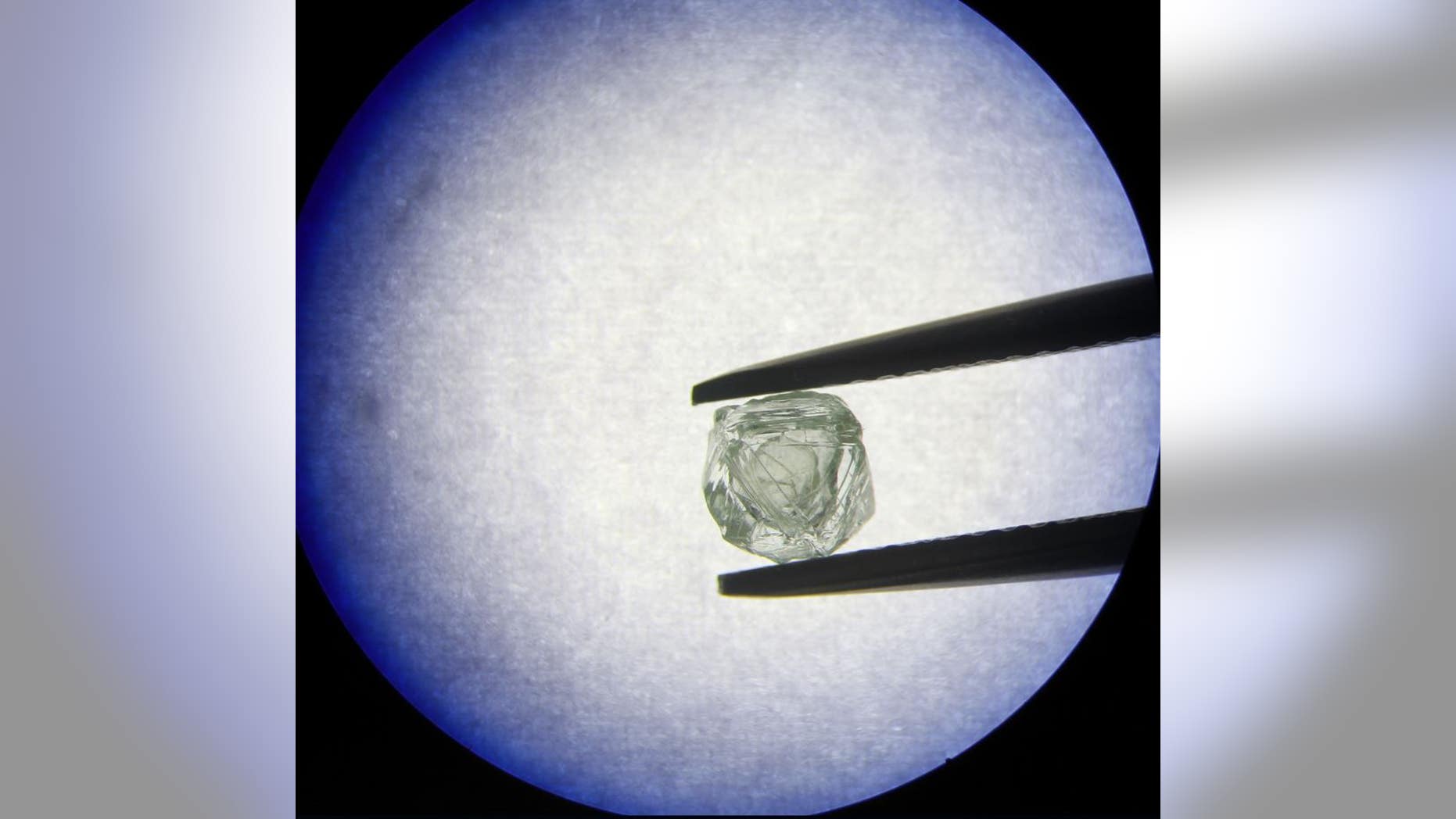

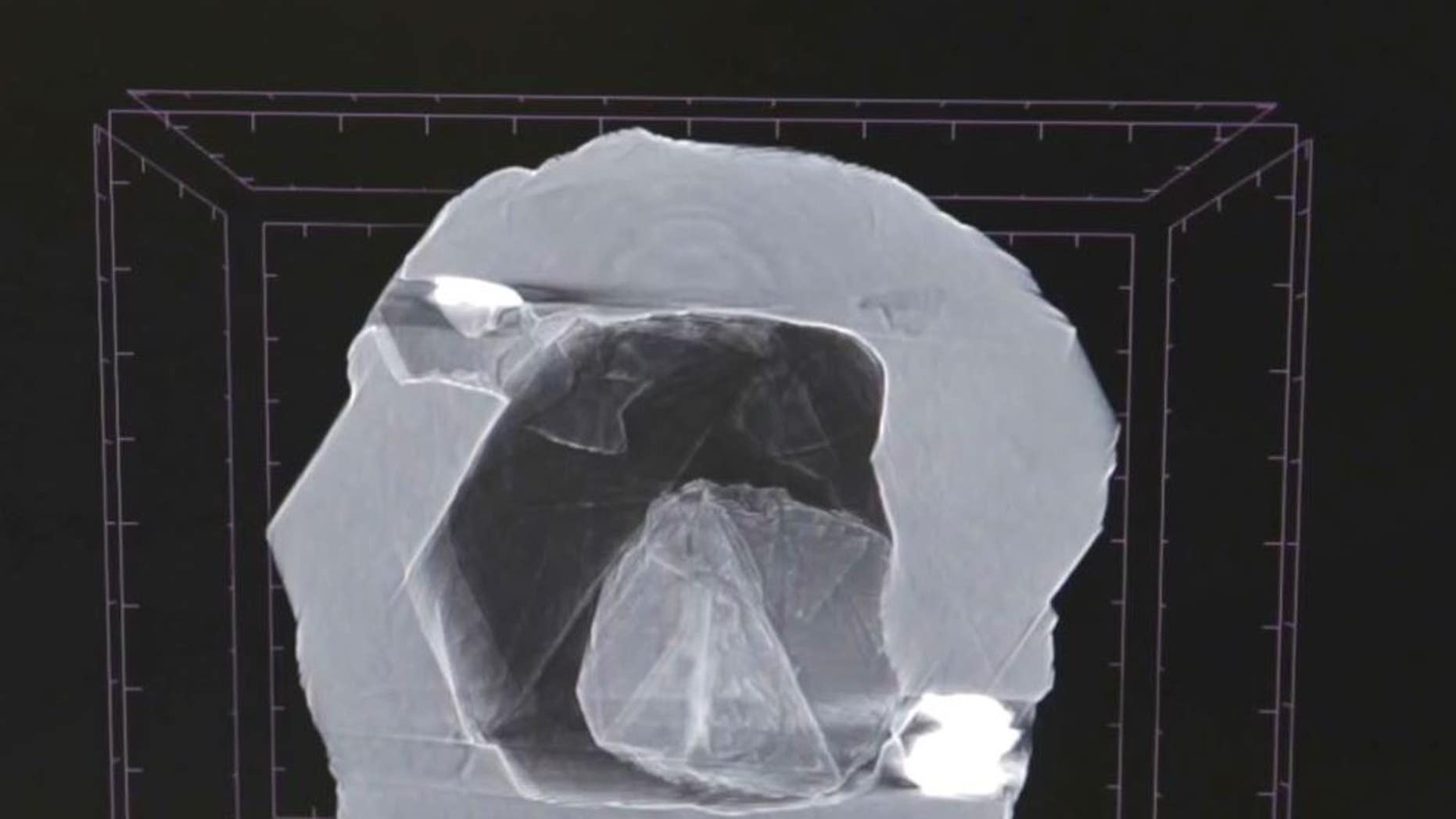

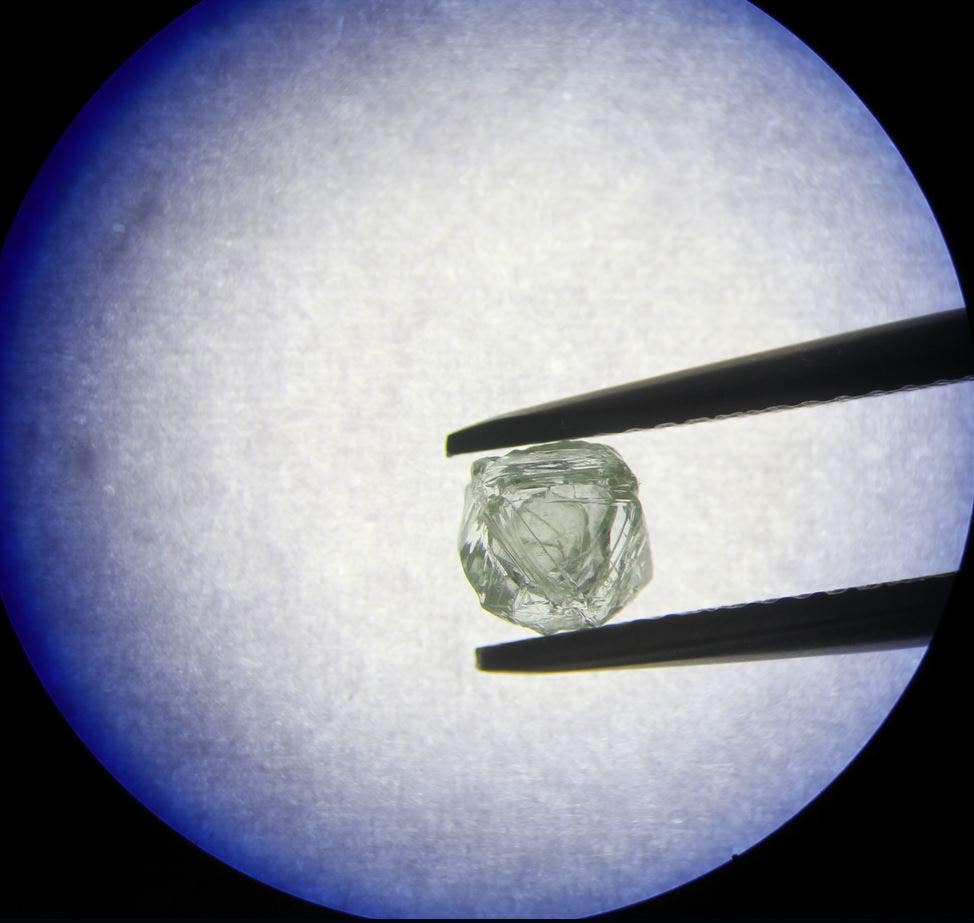

First-ever diamond within a diamond, found in Russia, is said to be 800 million years old

www.foxnews.com

First-ever diamond within a diamond, found in Russia, is said to be 800 million years old